Tezos glossary: DeFi

DeFi is an ecosystem of independent smartcontract services running on the blockchain to allow trading, lending and other capital utilization securely and without any intermediaries. We will explain the concepts most common in decentralized finance. This post is based on the Tezos DeFi Terms Explained and expanded.

If you don't know what is blockchain, baking, smartcontract, or dApp read the previous Tezos Basics first.

Decentralized finance concepts

CEX - a centralized exchange is a centrally controlled platform used to trade crypto assets. Centralized exchanges act as intermediaries between buyers and sellers. These platforms are custodians of user data and funds. [more]

DEX - a decentralized exchange enables investors to deal directly with each other instead of operating from within a centralized exchange. In transactions made through decentralized exchanges, the typical third-party entities which would normally oversee the security and transfer of assets (e.g. banks, stockbrokers, online payment gateways, government institutions, etc.) are substituted by smart contracts on a blockchain. [Wikipedia]

AMM (Automated market maker) - A type of DEX that works as a robot that’s always willing to quote you a price between two assets. Some use a simple formula like Uniswap, while Curve, Balancer and others use more complicated ones. Not only can you trade trustlessly using an AMM, but you can also become the house by providing liquidity to a liquidity pool. This allows essentially anyone to become a market maker on an exchange and earn fees for providing liquidity. AMM systems took off after they were first implemented by Shearson Lehman Brothers and ATD in the early 1990s.

Liquidity providers - users who deposit funds into liquidity pools to earn trading fees.

Liquidity pool - a smart contract on AMM DEX storing two token types at the same time. For example, the kUSD/XTZ pool stores kUSD and tez. When the DEX’s user exchanges kUSD for tez, the exchange adds kUSD to the kUSD/tez pool and returns tez from the pool to the user. The exchange rate depends on the token ratio in the pool: the less tez there is, the more kUSD it will take to pay for the exchange, and vice versa. [What Are Liquidity Pools in DeFi and How Do They Work?]

LP tokens - a representation of share in a liquidity pool. For example, a user has deposited liquidity in a kUSD/XTZ pool and got LP-kUSD-XTZ for that. Part of the trading fees on the pair is added to the pool for each trade. When they want to stop providing liquidity they return LP tokens and receive their share of the pool's funds back, including the accumulated fees (and the ratio of the two tokens can be different, see the Impermanent loss).

Impermanent loss - Although AMMs offer significant returns to LPs, there are risks involved. The most common is impermanent loss. This phenomenon arises when the price ratio of assets in a liquidity pool changes. LPs who have deposited funds in affected pools automatically incur an impermanent loss. In other words how much more money someone would have had if they simply held onto their assets instead of providing liquidity. The larger the shift in the price ratio, the larger the loss. However, this loss is called impermanent for a reason. As long as you do not withdraw deposited tokens at a time that the pool is experiencing a shift in price ratio, it is still possible to mitigate this loss. The loss disappears when the prices of the tokens revert to the original value at which they were deposited. Those who withdraw funds before the prices revert suffer permanent losses. Nonetheless, it is possible for the income received via transaction fees to cover such losses. [Impermanent Loss Explained]

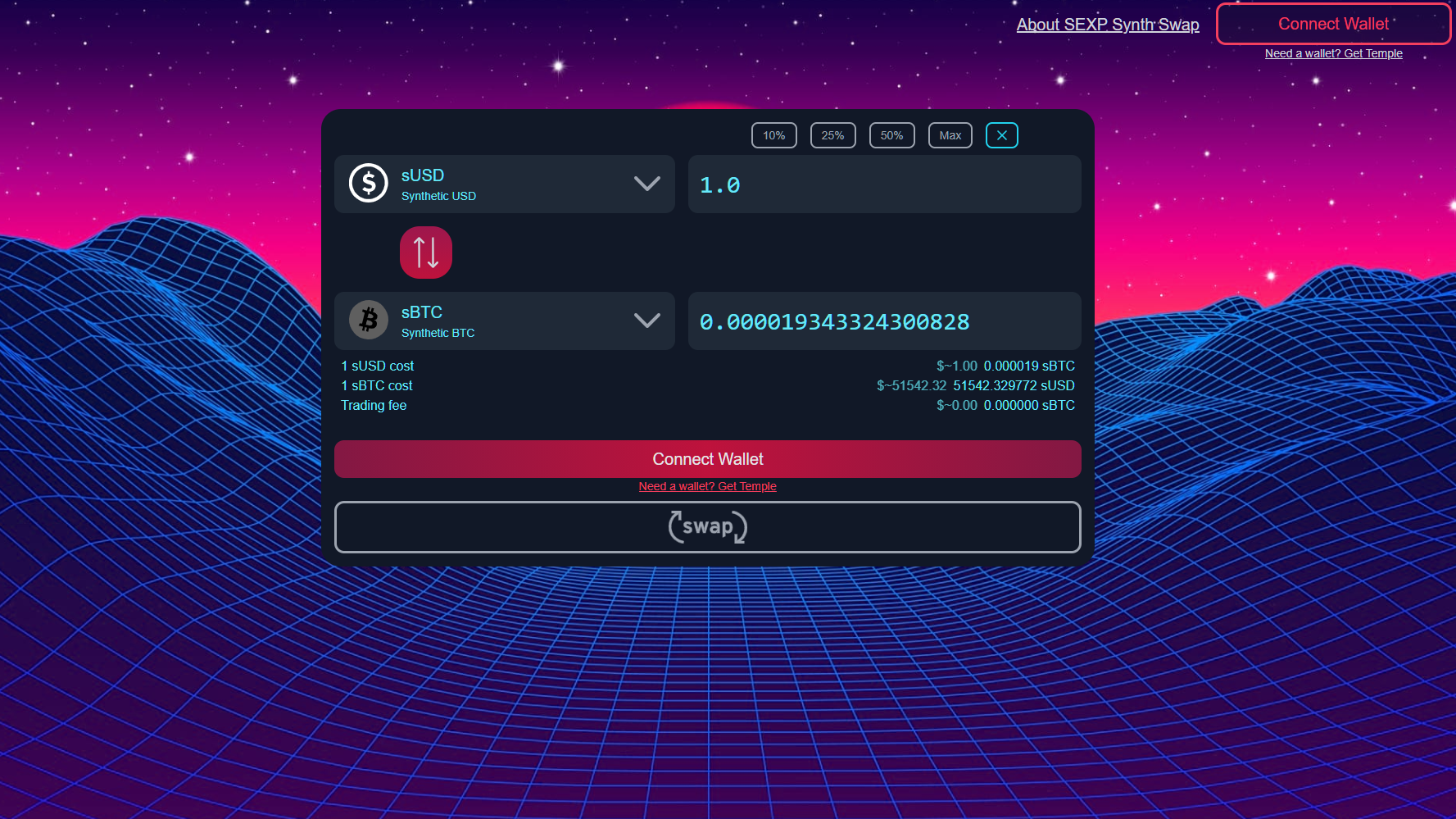

Slippage - exchange rate fluctuation while exchanging tokens at a DEX. For instance, with a 1% slippage, a user may get 1% fewer tokens than expected. Slippage gets larger with your order size on traditional AMMs. If you need zero slippage even with large orders you can use a synthetic DEX such as our new Synthetic Swap.

DeFi assets

tez or XTZ: the Tezos's native token. You need some tez in your wallet to pay the gas for each blockchain operation on Tezos. For example, each trade on our Synthetic Swap costs about 0.004 tez in gas. [XTZ price history]

Fiat money - regular everyday money like euros or dollars. [Wikipedia]

Stablecoin - a token whose price is pegged to fiat money. [Wikipedia]

Stable pair - a pair of tokens pegged to the same underlying, such as kUSD/uUSD, or wBTC/tzBTC. Due to their mostly similar price, there are special AMMs like Curve.fi with formulas designed especially for stable pairs exchange.

Wrapped Asset - An asset from another blockchain. The original asset is locked in a wrapper, a digital vault that allows the wrapped version to be created on Tezos blockchain. Wrapped assets require the specific asset to be locked in the original environment in order to issue the wrapped tokens on the selected blockchain at a 1:1 ratio. [Wrap on Tezos]

Synthetic Asset - Synthetic assets do not require the blocking of the original asset. They need an oracle that will track the price and provide it to the smart contract. They are backed on-chain with collateral. For example, Youves on Tezos is a DeFi service that allows users to mint synthetic USD by locking a (several times larger) collateral in XTZ. Our Synthetic Swap also works on the same principle just with more different assets. Learn more about synthetics in the Madfish article:

DAO tokens - tokens giving one a vote in project governance [Decentralized autonomous organization]

Market Cap - market value of tokens calculated as “number of issued tokens times price of one token.”

Staking, APR, and APY

Staking - locking tokens in a specific smart contract to earn rewards (do not confuse with Tezos baking/delegating, where your tez are not locked).

TVL - means total value locked. It is the measure of how much money users have deposited in a particular smart contract, pool, or project.

Yield Farming: a set of strategies of depositing funds in liquidity pools, staking, and reinvesting profits to maximize income. Certain projects automatically invest their user funds according to the most profitable strategies.

A farm is a smart contract or a project for yield farming.

APR stands for annual percentage rate. It shows the interest accrued over 12 months. Thus, “staking with a 100% APR” means that the investor will get 100% of the invested funds in a year.

APY stands for annual percentage yield. It shows the annual profitability with the consideration of recurring reinvestment of profits. Thus, an investor stakes funds at a 100% APR and reinvests the profits every day. In 12 months, they will get 171% of the invested funds, which means that APY in this case is 171%.

APR and APY show the reward in tokens, not fiat. You get your reward in the same tokens you had staked. Over a year, the token’s price may drop, so the eventual profit may be lower than advertised.

The values of APR and APY often depend on TVL (total value locked). Say, a staking contract sends 50 tokens every minute. Alice staked tokens worth $100 and gets 50 tokens a minute. The more TVL of the staking contract, the more investors share the common reward. Therefore, as TVL grows, the values of APR and APY go down.

That's all for today.

Don't forget to check what we are building on Tezos - the new Synthetic Swap DEX. Come try it on testnet for free:

The SEXP token sale will be open from Sunday October 17th to Sunday October 31st. Join SEXP Telegram if you want to learn more.